SAMESG®, our integrated ESG platform for streamlined reporting, compliance, and performance tracking

Streamline your financial planning, consolidation, and reporting with clarity and confidence

Simplified emission tracking and disclosure, custom-built for small and medium-sized businesses taking their first steps in sustainability

Join the forward-thinking organizations using our platforms and advisory expertise to accelerate performance, compliance, and transformation.

SAMESG® empowers organizations to take control of their ESG journey, turning complex data into clear insights, enabling smarter decisions, and ensuring seamless compliance across global standards.

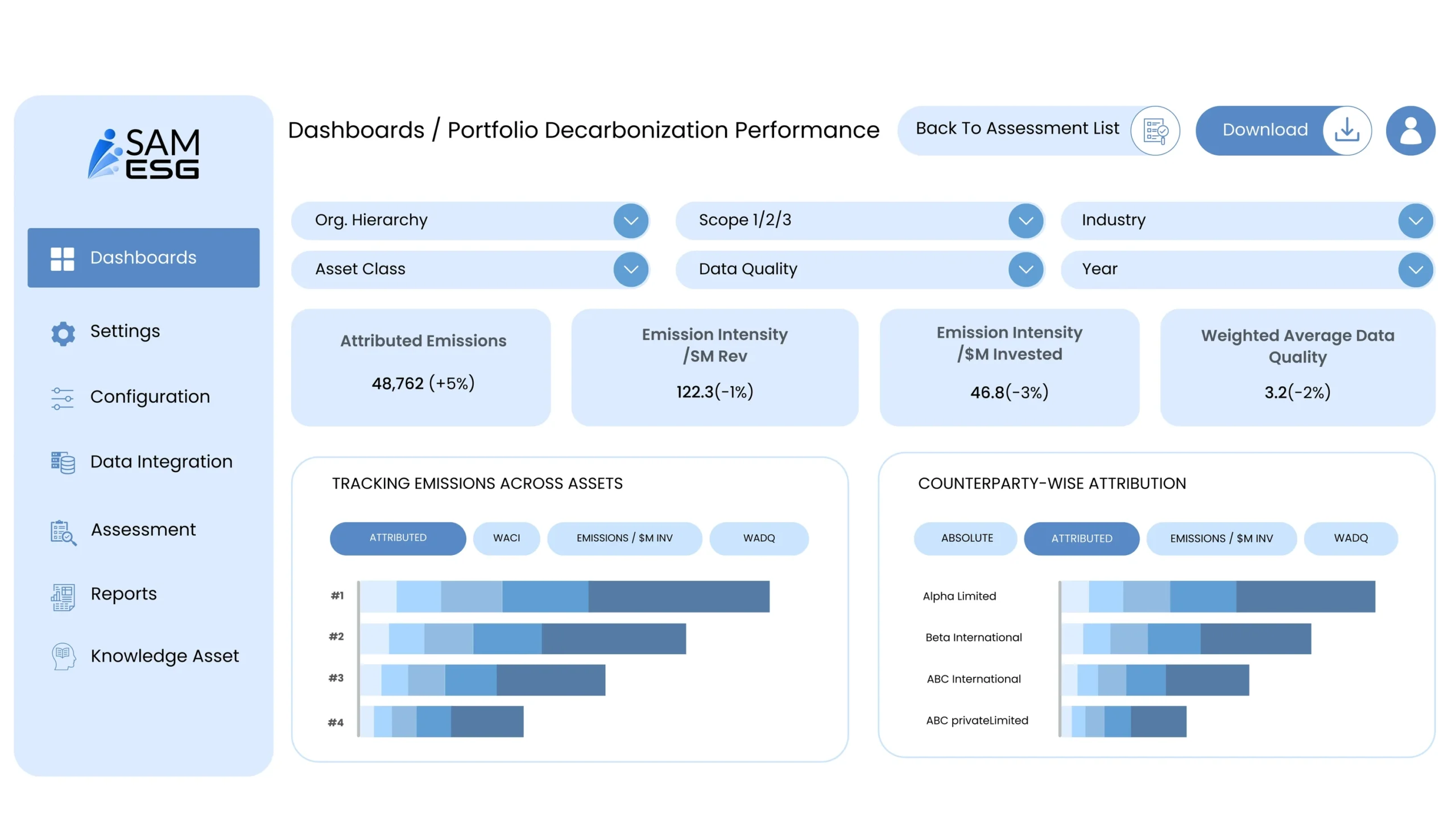

See Your Progress

Full visibility of net-zero progress across divisions, sectors, and investments

Monitor Every Emission

Track emissions from assets to counterparties using reliable data sources

Spot Risks & Potential

Identify opportunities, risks, and demonstrate tangible ESG outcomes

Focus on What Matters

Prioritize and measure emissions reduction initiatives across your portfolio

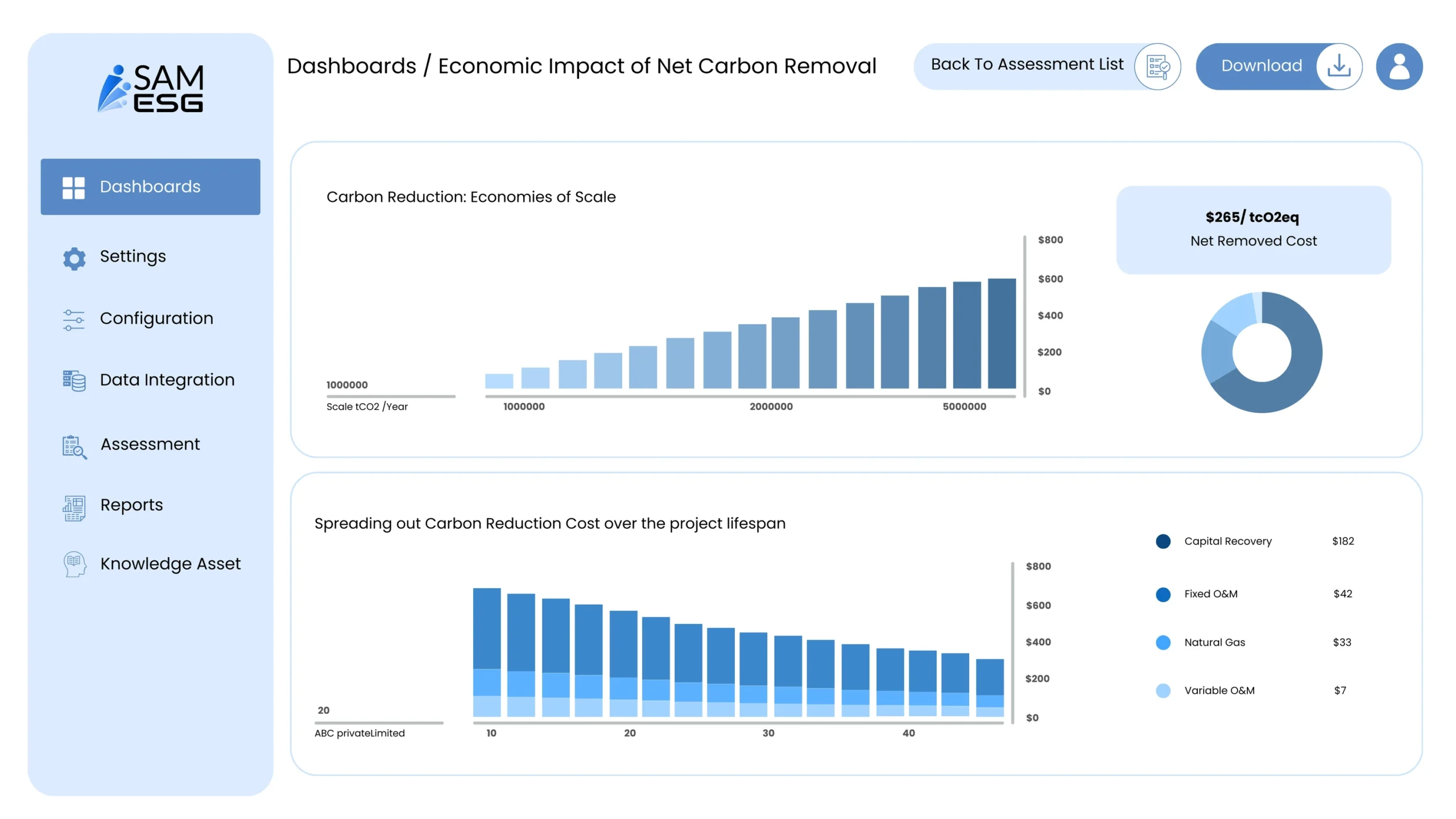

Measure Impact Clearly

Quantify the financial and environmental returns of each initiative

Maximize Carbon Savings

Allocate resources strategically to maximize carbon savings and impact

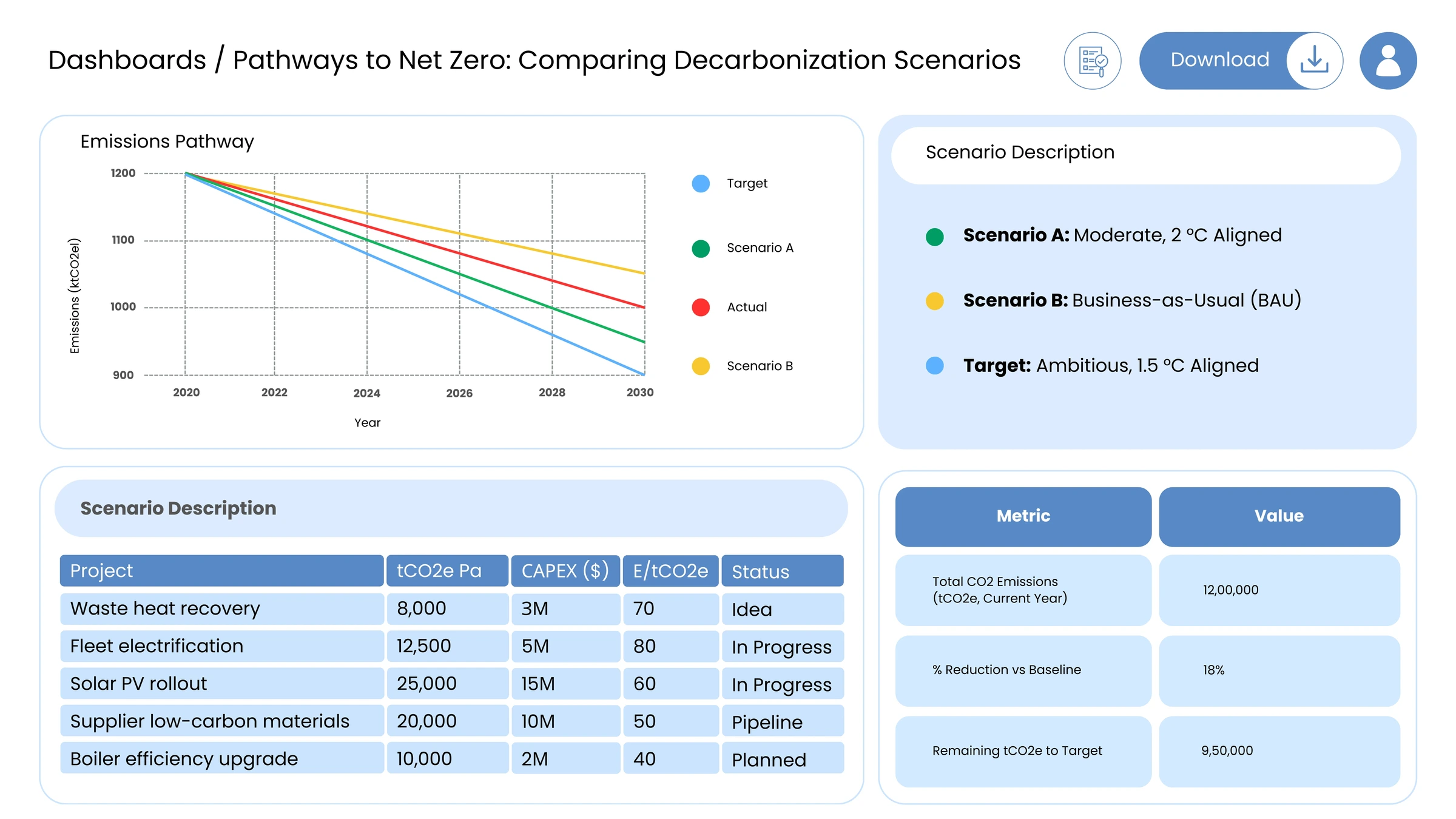

Explore Multiple Scenarios

Assess decarbonization scenarios with AI-powered modeling and insights

Choose the Most Efficient Path

Identify cost-efficient, high-impact pathways for carbon reduction

Optimize for Results

Compare projected trajectories and optimize strategies at portfolio or project level

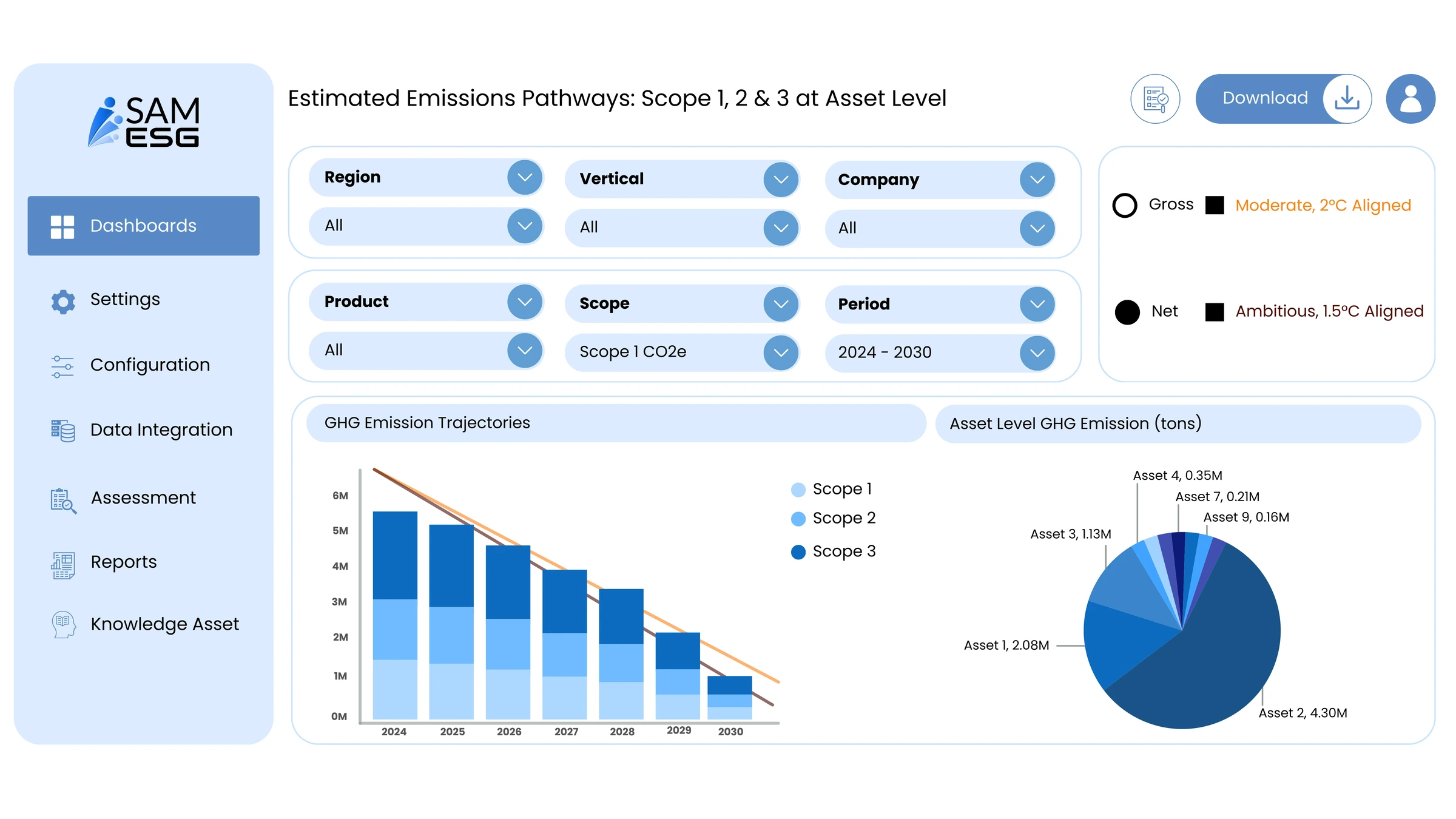

Understand Asset-Level Impact

Track emissions at the asset level with forward-looking projections

Break Down Emissions by Scope

Map Scope 1, 2, and 3 contributions for each asset precisely

Target High-Impact Actions

Target high-impact reduction areas and align sustainability with operations

We help organizations move beyond compliance to develop ESG strategies that create measurable impact, enhance transparency, and embed sustainability into business decisions.

Managed Services

Reduce operational burden on internal teams and processes

Ensure accurate, timely reporting across all ESG frameworks

Streamline ESG data collection, validation, and disclosures

Align ESG initiatives across divisions and subsidiaries

Consulting & Training

Help teams interpret and apply ESG frameworks effectively

Build capacity with role-specific, practical learning modules

Promote a culture of accountability, sustainability, and compliance

Support leadership with actionable insights and best practices

CPM helps finance teams simplify complex processes, providing accurate, real-time insights to drive smarter planning, reporting, and compliance across your organization.

Use actionable insights and scenario modeling to respond quickly to business changes and market dynamics.

Automate financial close and consolidation across entities, currencies, and inter-company structures efficiently.

Unify budgeting, forecasting, and analytics in one connected system to align strategy and performance.

Leverage centralized data and advanced analytics to gain real-time insights into profitability at a granular level.

Connect finance and operational teams to promote collaborative planning and reporting, ensuring organizational alignment.

Ensure lease accounting compliance with pre-configured automation, audit-ready disclosures, and simplified reporting.

Gain clarity and control over complex processes with solutions that simplify decisions, strengthen strategy, and future-proof your business.

Support for enterprise, model, operational, market, credit, and liquidity risk management across financial organizations.

Support for governance, risk management, and regulatory compliance across financial organizations.

Flexible support via collaborative internal partnerships or fully managed risk functions with standardized processes.

Enable agile and informed financial decision-making with dynamic modeling, improved liquidity management, and optimized balance sheet performance.

Implement proactive risk frameworks that reduce exposure, support long-term resilience, and integrate risk considerations into strategy and operations.

Automate insurance contract accounting with centralized data, real-time validation, and transparent regulatory reporting to meet IFRS 17 standards.

Automate BRF submissions with centralized data, real-time validation, and checks, ensuring accurate, compliant, and timely CBUAE reporting.

Consistently delivering measurable impact and real results that speak for themselves.

Learn best practices, overcome challenges, and discover actionable strategies that drive measurable impact.

Environmental, social, and governance reporting has become an established part of corporate disclosure…

For most finance teams, the year-end close is a high-pressure marathon: long hours,…

Activities in the food industry, from farm practices to packaged foods, have lasting…

New York has introduced one of the most comprehensive mandatory greenhouse gas reporting…

Singapore’s ESG reporting landscape is shifting toward mandatory, assured climate and sustainability disclosures.…

Construction enterprises operate in one of the most complex financial environments across industries.…

Case Study How a Leading Italian Utility Modernized Financial Consolidation and Compliance How…

Large, distributed organisations often struggle with ESG reporting due to high data volumes,…

Shipping and logistics companies face mounting pressure to measure, track, and disclose ESG…

The International Public Sector Accounting Standards Board (IPSASB) has released “IPSASB SRS 1,…

The Science Based Targets initiative (SBTi) has surpassed 10,000 companies with validated climate…

The UK’s Competition and Markets Authority (CMA) has released new guidance clarifying that…

Real stories of success, efficiency gains, and strategic transformation that highlight the value we bring to organizations across industries.

The Network of Strategic Partners That Power Every Outcome We Achieve.

Real stories of success, efficiency gains, and strategic transformation that highlight the value we bring to organizations across industries.