As businesses worldwide pivot toward responsible and sustainable practices, Indian...

Think Beyond Today, Invest in a Sustainable Tomorrow with SAMESG® Reporting

All-in-one ESG Solution | ESG Reporting | Compliance | Insights

With over a decade of industry expertise, we’ve delivered solutions for medium to large enterprise clients across the globe.

SAMESG® is a sophisticated sustainability reporting software to improve your corporate responsibility efforts and build a sustainable future. Take a glimpse at our ESG reporting software’s capabilities.

Easy Data Consolidation: With the power of our sustainability reporting software, you can easily collect and collate quantitative and qualitative data from multiple data sources.

Organizational Hierarchy Management: Our ESG solution allows you to collect data from different verticals, subsidiaries, departments, and units and produce standalone and aggregate reports, with accesses managed through our advanced workspace and user role management.

Value Chain Assessment: Our ESG reporting tool will help you gather vendor insights via surveys, calculate Scope 3 emissions from Tier 1 & Tier 2 partners, and assess suppliers on sustainability, carbon emissions, and ESG risks.

Align with Global Standards: With our sustainability reporting software, you can identify high-risk suppliers and ensure compliance with global ESG standards (GRI, SASB, TCFD, BRSR, ESRS).

Countless Data Integration Options: With SAMESG® reporting software, you get various data load options such as direct data entry, Excel upload, automated data extraction, and much more.

AI/ML Features: Our ESG reporting tool provides AI/ML capabilities, allowing you to capture relevant data from handwritten text or PDF files into the tool without manual interventions.

Auto-Generate Disclosure Reports: With our dynamic report builder accessible through our sustainability reporting software, you can instantly generate disclosure reports in Excel, PDF, or XBRL formats with minimal to zero intervention.

Free Access to SAMRUS® (SAM Regulatory Update Service): SAMESG® provides all our customers with free upgraded regulatory reports in case of any change in disclosure requirements, irrespective of your regulatory jurisdiction or ESG framework.

SAMESG® leverages AI to simplify the end-to-end ESG journey, enabling organizations to focus on strategy rather than manual processes.

SAMESG® is equipped with intelligent readers that scan and extract critical ESG data from a wide range of sources, including PDFs, spreadsheets, scanned files, and even handwritten reports. This minimizes manual effort, reduces errors, and accelerates the reporting process.

Generate ESG-compliant reports instantly with the power of natural language interaction. It lets you type in your request in plain language whether it’s a complex disclosure, a specific insight, or a performance summary and SAMESG® delivers, removing technical barriers for users across functions.

Our AI continuously adapts to your usage patterns. By learning from your inputs and refinements, it enhances accuracy in data extraction, reporting suggestions, and insights over time. The result is a highly personalized and increasingly efficient reporting experience tailored to your organization’s needs.

SAMESG® is designed to handle the complexity of global operations. It seamlessly supports multiple data formats and reporting requirements across different regions, enabling smooth consolidation and consistent ESG disclosures at scale.

We have delivered cutting-edge ESG reporting solutions to medium and large enterprise clients worldwide. Our ESG platform helps organizations to improve compliance, drive sustainability performance, and achieve measurable environmental and social impact.

Very sophisticated and an end-to-end ESG reporting software.

Keeping it light, responsive and fully optimized data models.

Adaptable to changing reporting requirements and scalable to your business growth.

Banks

Asset Mangement

Insurance

Manufacturing

Retail

Real Estate

Automobile

Pharma

Service

Others

SAMESG® Solution draws upon proven frameworks (such as GRI, SASB, TCFD) to maximize ESG performance. Kickstart your journey to sustainability today!

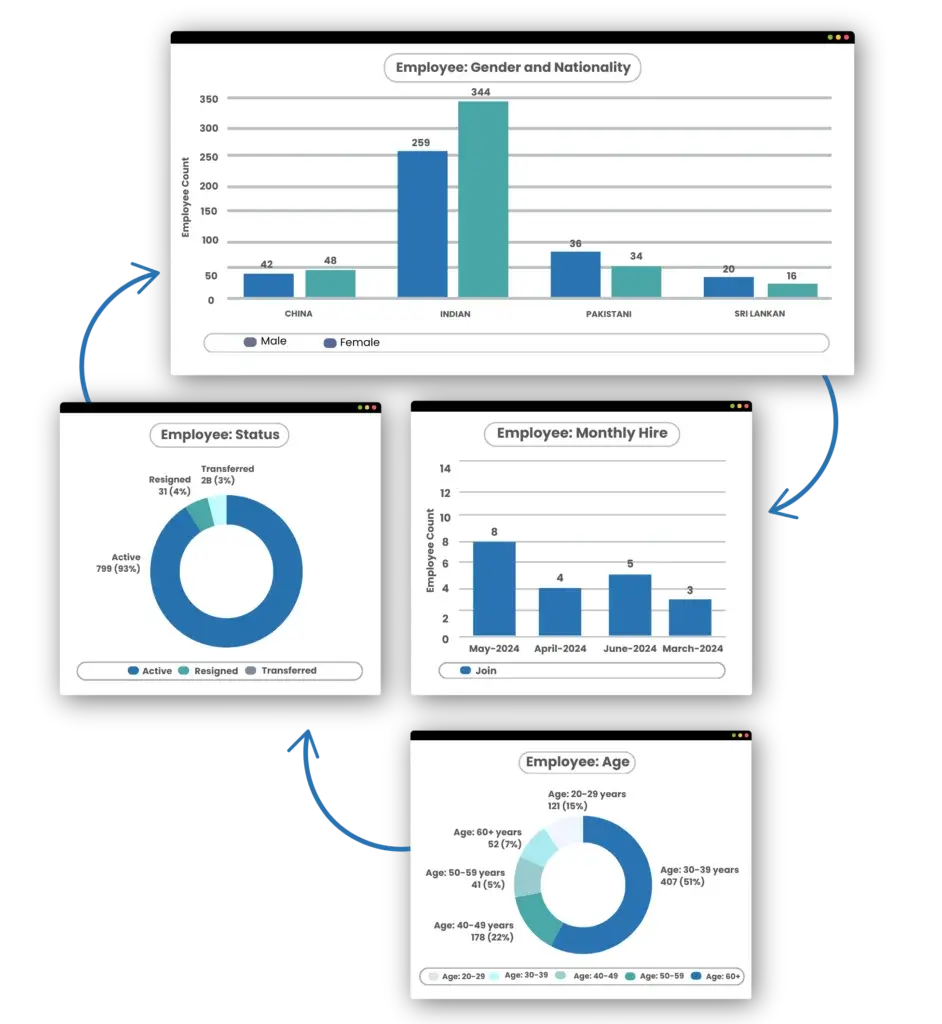

Our high-octane sustainability reporting software will help you set KPIs aligned with ESG strategy, data collection, tracking, and monitoring of ESG performance with dashboard reporting capability and sustainability disclosures.

With over a decade of experience and expertise in ESG led by industry-renowned domain experts, we drive present and future value.

More than 800 entities worldwide trust SAM’s integrated ESG, FinTech and Consulting solutions to build lasting value.

No hidden charges, extra fees, and absolutely no surprises for regulatory report update requirements!

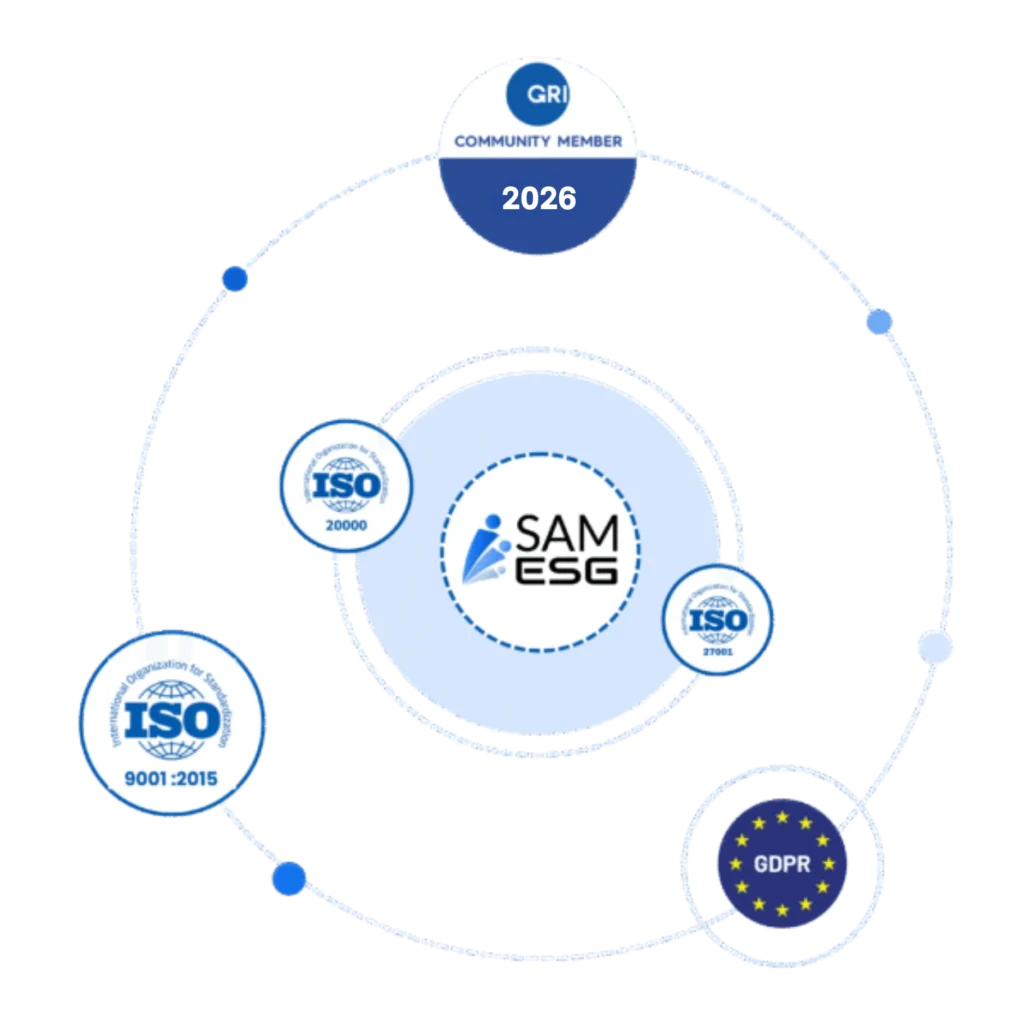

We are ISO certified for Quality, Information Security, and IT Service Management while ensuring full GDPR compliance.

Since 2024, we have been a member of the global network of organizations for Sustainability Reporting by (Global Reporting Initiative) GRI Community.

Recognized as the “Best Leader in ESG Technology Solutions” at the 7ᵗʰ ESG Summit & Awards 2025 and “Best ESG Platform” at the CSR Leadership Summit & Awards 2024.

Measure ESG progress in just one minute. Assess your ESG readiness today and gain insights that will guide you toward a more sustainable future.

Essential

Maturity Assessment

Scope 1

Scope 2

KPI Basic (Fixed KPIs related to industry)

Excel based data upload

Data Visualization with Standard Reports

Standard Disclosure Report

Data Backup

Basic

Everything in the essential plan

Scope 3 (Only Cat 5,6,7)

Materiality Assessment

KPI Setup and Tracker

Data Visualization with Custom Reports

Rest API Integration

Advanced

Everything from the basic and essential plans.

Scope 3 (all categories )

Target Setting & Monitoring

Stewardship Activities Tracker

Portfolio Carbon Footprint Monitoring

Dynamic Reporting

Tasks and Alert management systems

Power BI Integration

Value Chain Assessment

Data Capturing through LLM

*Customizable as per your needs

with SAMESG®

Talk to our domain experts and learn more about how our sustainability reporting software can help achieve global compliance.

ESG reporting software is an all-in-one tool to help organizations track, measure, and report their ESG performance. It enables companies to monitor their sustainability initiatives, assess risks, and comply with regulations.

The ESG reporting software is essential for companies aiming to improve accountability and simplify their sustainability efforts. It automates data collection, reduces human error, and helps in easy reporting. By using ESG software, organizations can:

For businesses, sustainability reporting software is a strategic investment for compliance and long-term growth.

A materiality assessment is a process where a company identifies the potential and critical environmental, social, and governance issues and other emerging topics closely linked to its business operations. This assessment is essential for shaping the company’s ESG strategy. It helps set meaningful targets by employing a data-driven method for selecting and prioritizing ESG metrics to monitor and report.

Countless ESG frameworks and standards offer guidance to companies in their reporting and sustainability practices. A few of them are listed below:

These frameworks help organizations ensure that their ESG reporting is consistent, comparable, and reliable.

As investors demand more consistent and comprehensive ESG data, many countries are adopting mandatory ESG disclosure requirements. Notable regions with existing or proposed regulations include the UK, France, the EU, Singapore, Australia, India, UAE, the US, and many other jurisdictions.

Read the latest insights, case studies, and white papers from our FinTech experts.