Insurance Industry : ESG risks & opportunities and the way forward The Insurance...

Read More

Implementing ESG framework requires active engagement of different stakeholders starting from Board to Senior Management, executives and staff. All business processes need to be reviewed from ESG perspectives and re-orient them with ESG enabled business strategies of the organization.

SAM Corporate has joined the Global Reporting Initiative (GRI) Community, marking our significant stride towards creating awareness of sustainability and ESG reporting.

ESG and Sustainability are buzzwords in today’s business world. Sustainability refers to the ability to meet needs of present without sacrificing the ability of our future generations. From business perspective, it implies conducting business operations ethically, responsibly and transparently while leaving less negative impacts on the society and environment. ESG, Environmental, Social and Governance is a framework through which a business can embrace Sustainability in a measured way.

ESG has been on top of the agenda for the corporate boardrooms in recent times due to wide spread awareness of green economy, changing consumer preferences, and investors inclination towards responsible/ impact investing coupled with the regulatory initiatives on climate-related disclosures by businesses.

The changing dynamics of the market have made it necessary for the businesses to adopt ESG and sustainability principles as an integral part of their operations. This would enable the businesses to remain transparent to its stakeholders and capable of better managing its risks while optimizing on the new business opportunities arising from the current changing market dynamics. Businesses look at Sustainability as a holistic approach to create long term value for their stakeholders and society at large, while pursuing their business objective of maximizing shareholders’ wealth.

Some of the benefits the ESG enabled organization would receive in the long run to mention a few are:

Enhanced Brand Image and Reputation of the organization.

Attract prospective investors

Competitive edge on others in the market

Strong Strategic Alliances and partnerships with key stakeholder of the business.

Setting a Benchmark for peers

Improved efficiency and cost reduction

Implementing ESG framework requires active engagement of different stakeholders starting from Board to Senior Management, executives and staff. All business processes need to be reviewed from ESG perspectives and re-orient them with ESG enabled business strategies of the organization. Identify and set targets for ESG related KPIs. Track how the organization makes progress on its ESG transformation journey and make disclosures to its stakeholders. To achieve all of these, organizations should commit resources and build internal capability to implement ESG framework embedded with sophisticated IT systems so that the organization can better manage the risks and the opportunities arising from this market-wide ESG transformation.

SAM Corporate, as one of the leading FinTechs in the region has helped many our clients in the financial and non-financial sectors for successfully implementing solutions and systems in line with the regulatory requirements and industry best practices. What makes us distinguished from others in the market:

300+ years of collective domain experience

Deep understanding of the market trend

Hands on at the senior level

Long term client relationship hips with key stakeholder of the business.

Association with the industry think tank / standard setters

Value creation to our clients’ business

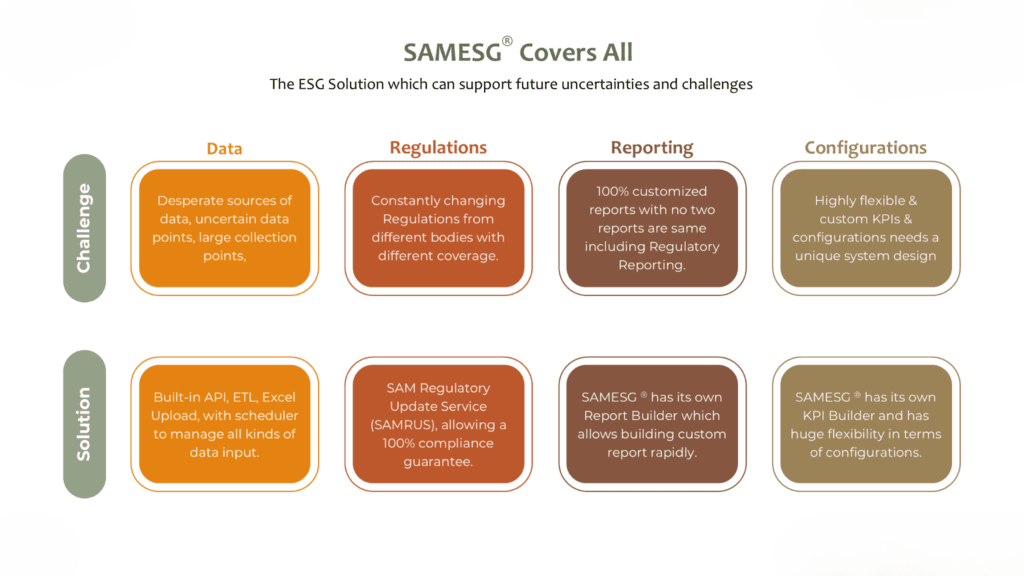

SAMESG® is strategically positioned to guide and support you through every step of your ESG transformation journey. With our end-to-end approach, we ensure you’re equipped to meet today’s demands and confidently navigate future uncertainties.

Our services include:

SAMESG® offers flexible plans based on the number of users and entities, with a minimum of 10 users included per entity in all packages. Our pricing is feature-based, with a detailed breakdown of all available features outlined below.

Essential

Maturity Assessment

Scope 1

Scope 2

KPI Basic (Fixed KPIs related to industry)

Excel based data upload

Data Visualization with Standard Reports

Standard Disclosure Report

Data Backup

Basic

Scope 3 (Only Cat 5,6,7)

Materiality Assessment

KPI Setup and Tracker

Data Visualization with Custom Reports

Rest API Integration

Advanced

Scope 3 (all categories except Cat #5,6,7 and 15)

Scope 3 Cat #15

Target Setting & Monitoring

Stewardship Activities Tracker

Portfolio Carbon Footprint Monitoring

Dynamic Reporting

Tasks and Alert management systems

Building a successful ESG program starts with understanding where your company stands. With just a few clicks, assess your readiness and unlock insights that guide you toward a more sustainable future.